Endorsements typically involve adding or removing employees as they join or leave organizations. From a technical perspective, managing endorsements in an insurance platform can involve a range of tasks, each with its own engineering complexities.

Here are some of the typical tasks:

- Policy Data Management: The platform must accurately track and manage all policy data. This includes the original policy details and any changes made through endorsements. The data management system must handle various data types and structures and provide a reliable way to track changes over time.

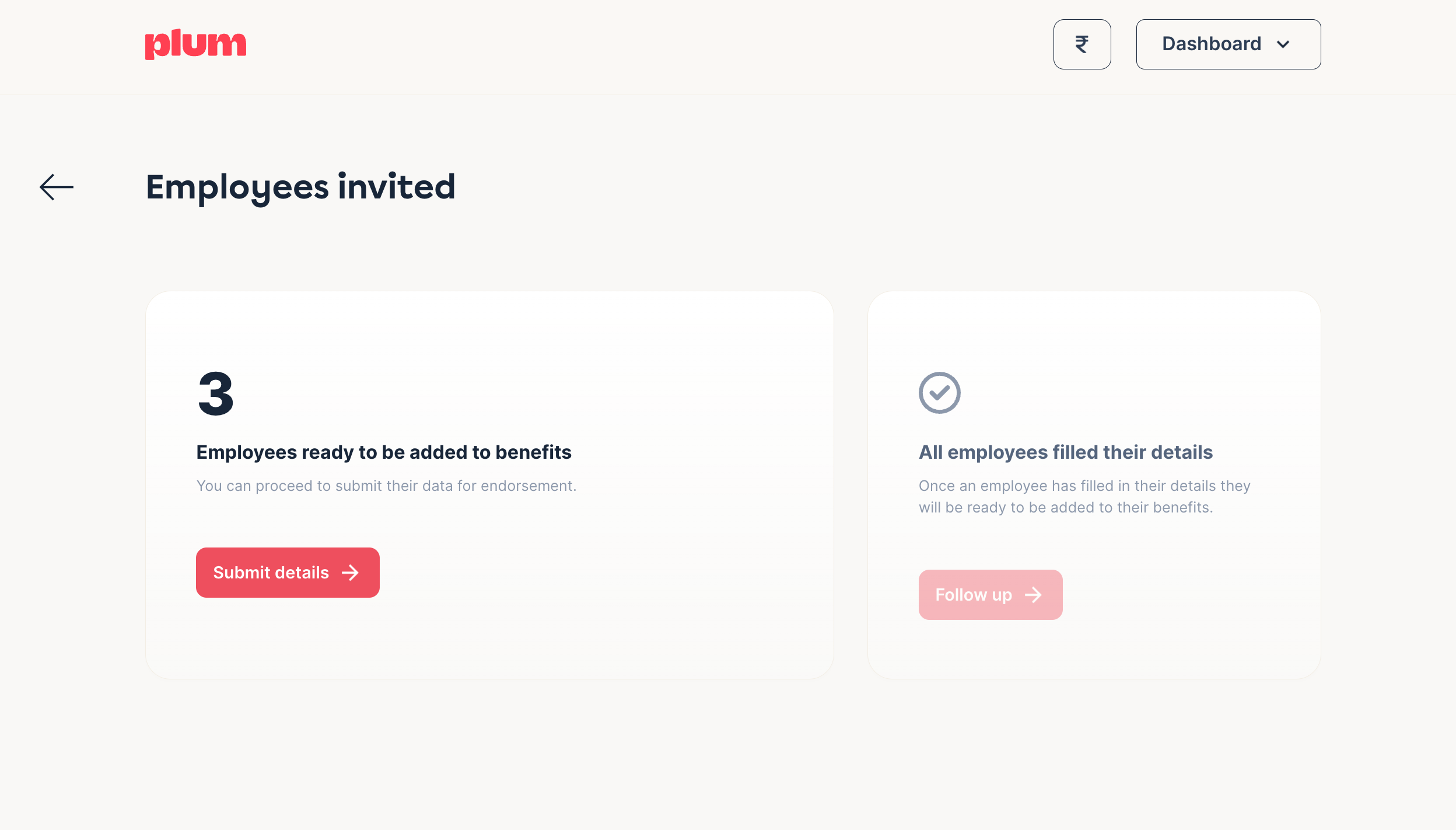

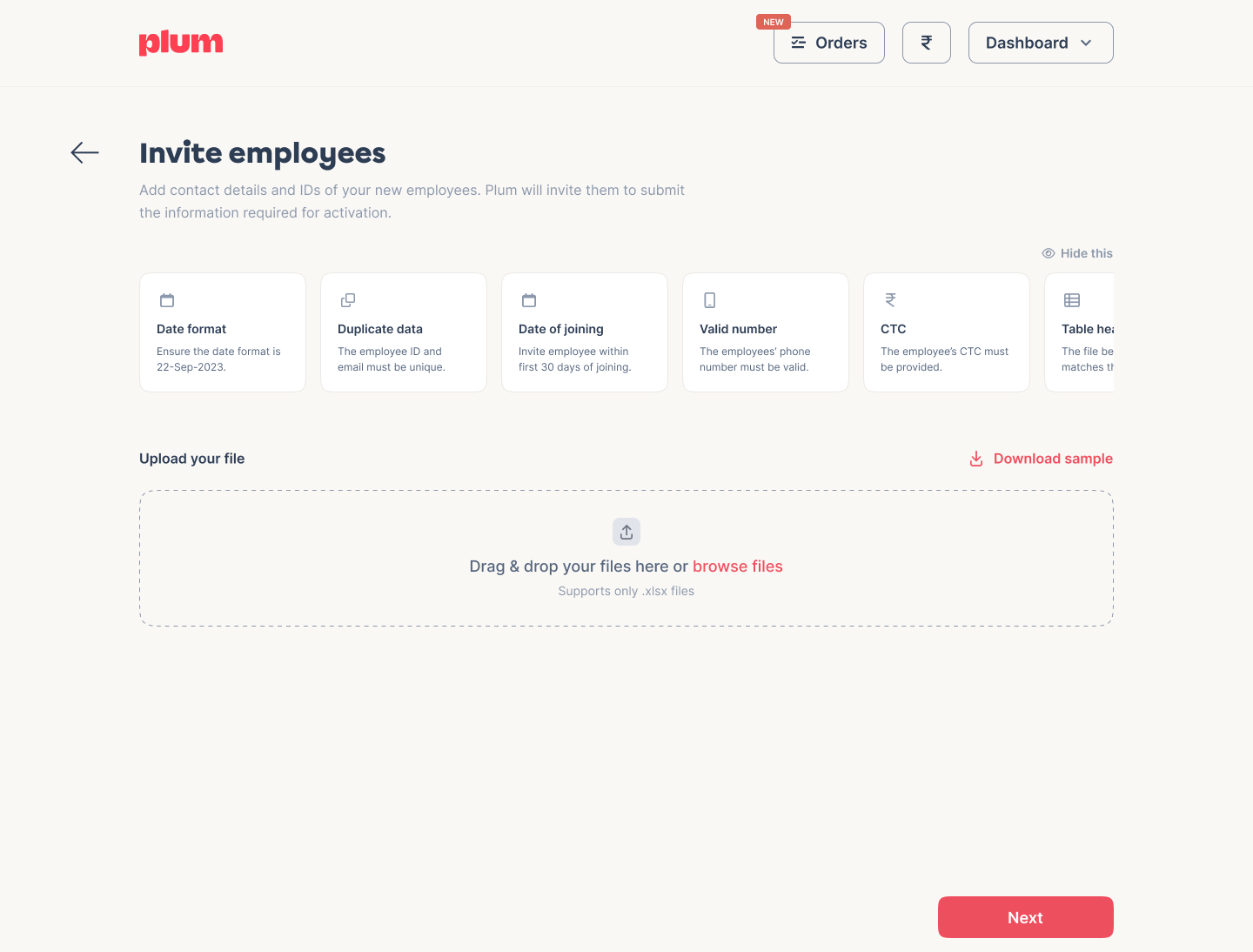

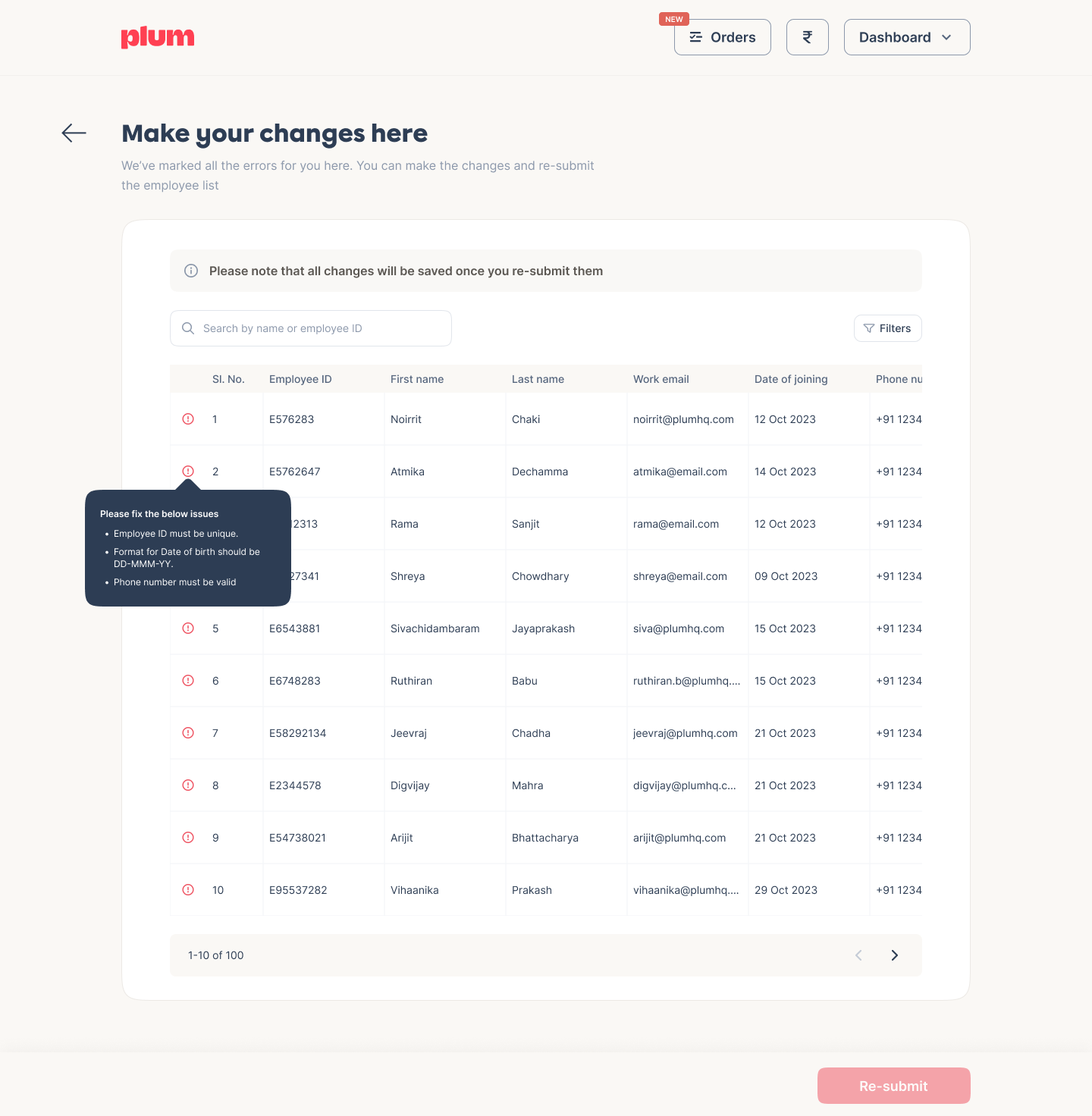

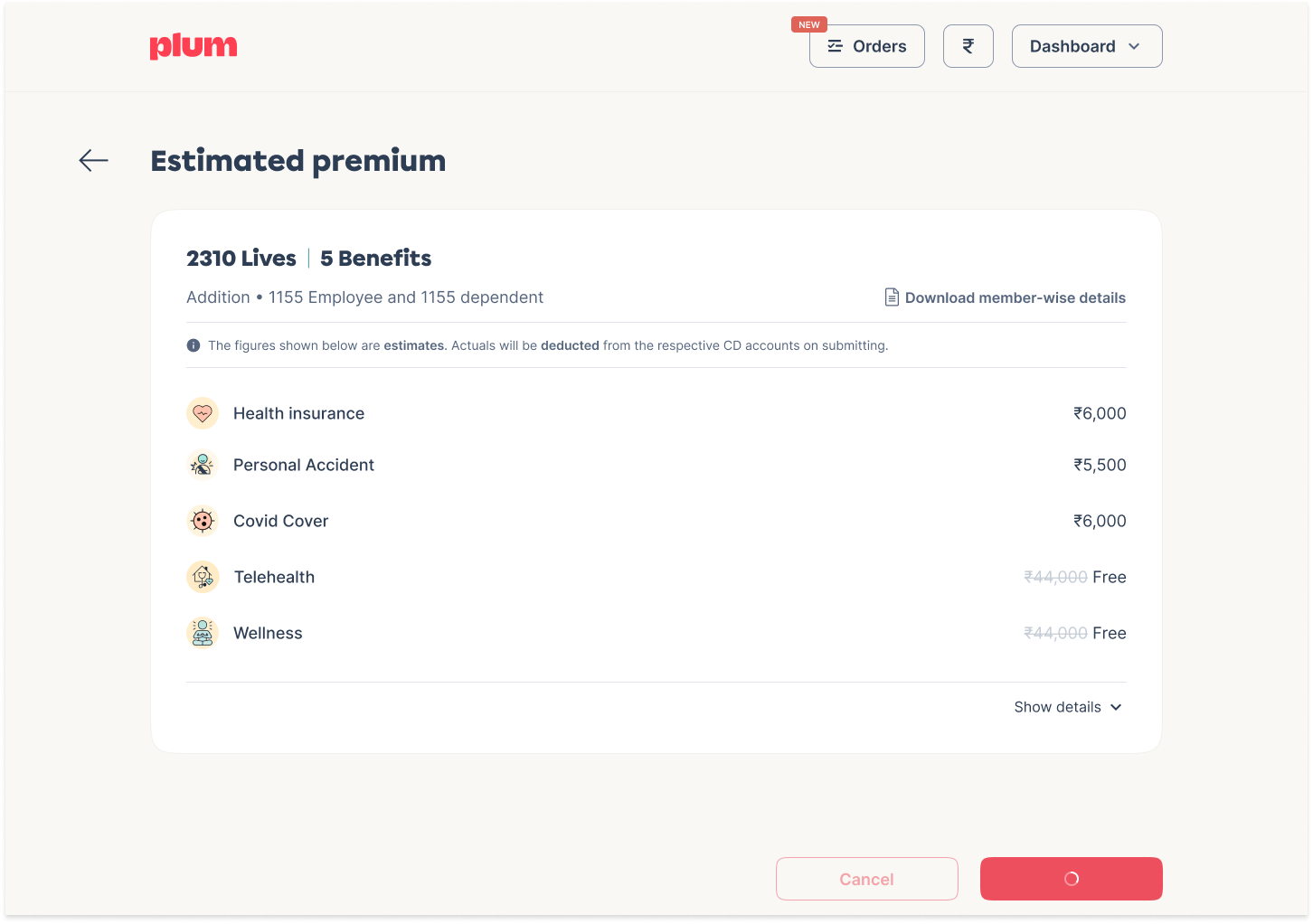

- User Interface: The platform should provide an intuitive interface allowing policyholders and administrators to request endorsements. This could involve form-based interfaces for entering new data, interactive policy summaries highlighting potential endorsement options, or other interface elements.

- Validation and Business Rules: When an endorsement is requested, the platform needs to validate the request against the policy's terms and conditions. This involves implementing business rules that define what changes are allowed, under what circumstances, and who can authorize them.

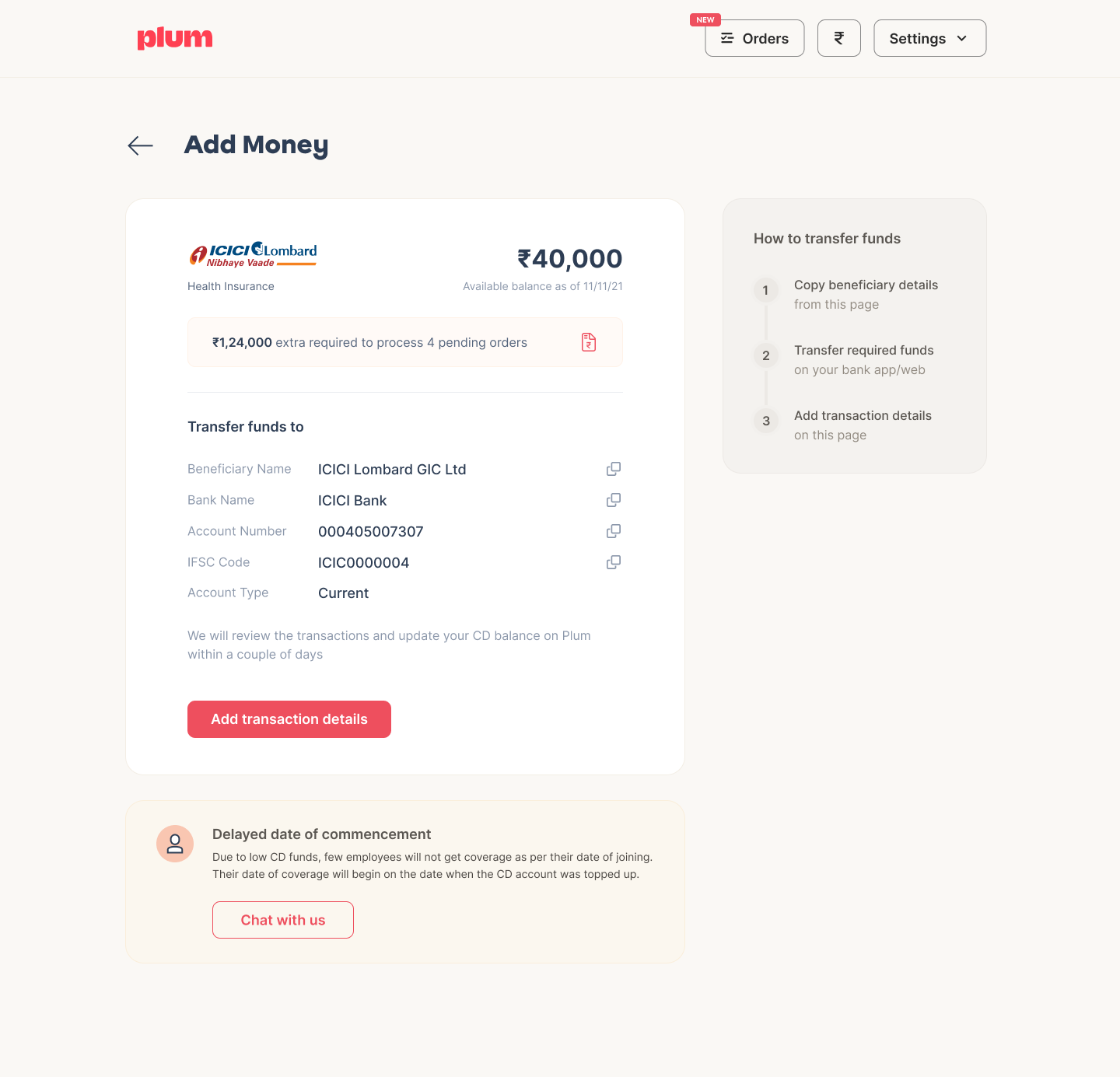

- Integration with Insurers: The platform needs to communicate with insurers' systems to submit endorsement requests, receive updates on their status, and update the policy data. This involves using APIs provided by the insurers or other integration mechanisms.

- Audit Trails: For compliance and customer service reasons, the platform needs to maintain a detailed audit trail of all endorsement activities. This includes who requested the endorsement, what changes were made, when the changes were made, and the status of the endorsement request.

- Notifications and Communications: The system should have a way to notify administrators about the status of endorsement requests. This could involve sending emails, generating notifications in a user dashboard, or other communication methods.

Implementing these features and functionalities requires a strong understanding of the insurance domain and the ability to design and implement complex workflows involving data models, validations, pricing and business logic. The engineering complexity lies in creating a robust and flexible system to handle a wide range of policy types, endorsement types, and user interactions.

Endorsements are a workflow problem.

Handling insurance endorsements could be represented as a series of workflows. Here's a high-level example of what these workflows might look like:

Endorsement Workflow:

- A user initiates an endorsement request via the user interface.

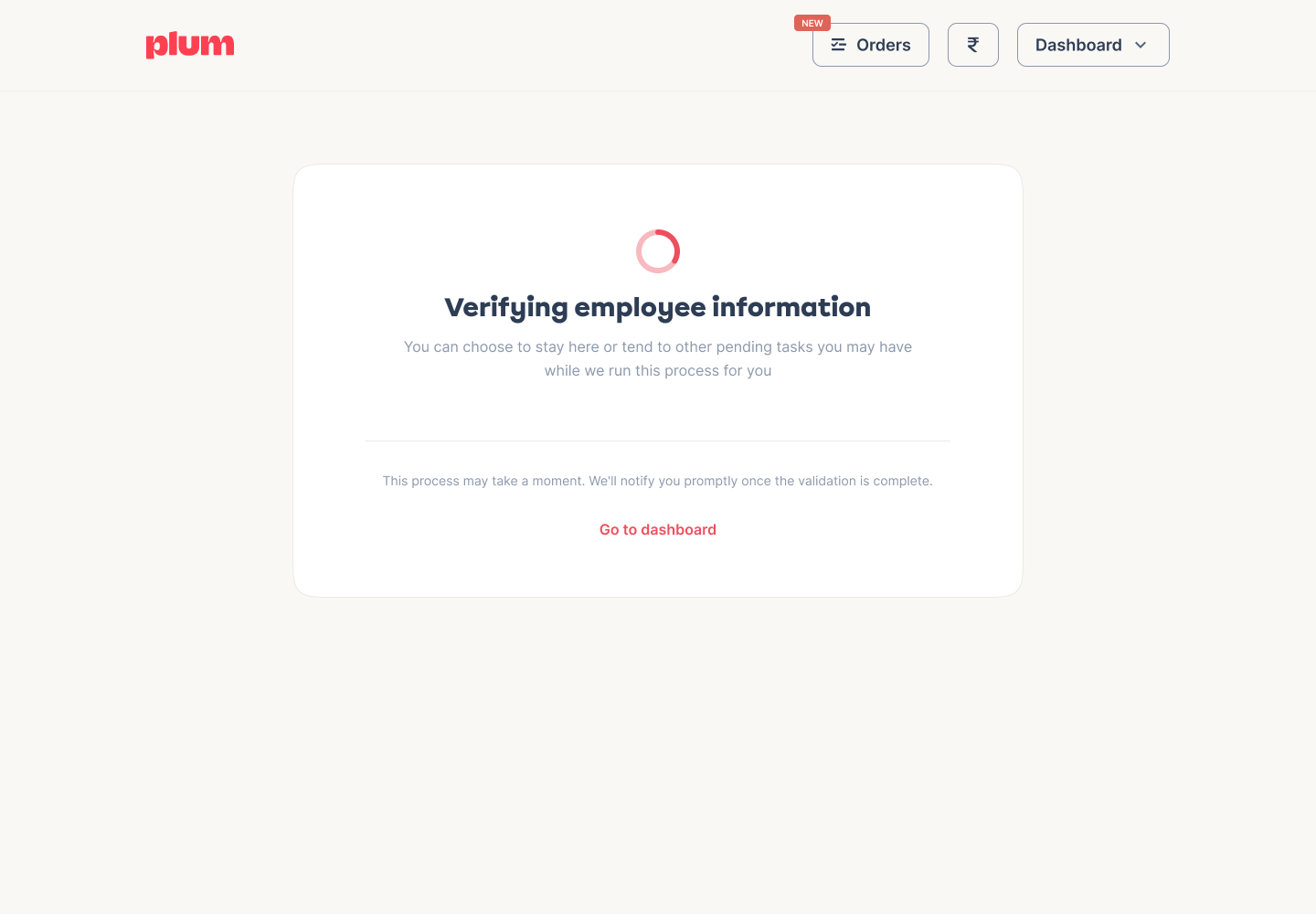

- The system validates and checks the user's input against predefined business rules.

- The system checks if a payment is required and collect payments to process the request.

- If the request is valid, it's saved in the database and forwarded to the insurer via API calls or other integration methods. If the request is invalid, the user is notified about the issue and allowed to correct it.

- The insurer receives the endorsement request and begins processing it.

- Updates from the insurer are received by the system, which updates the status of the endorsement request accordingly.

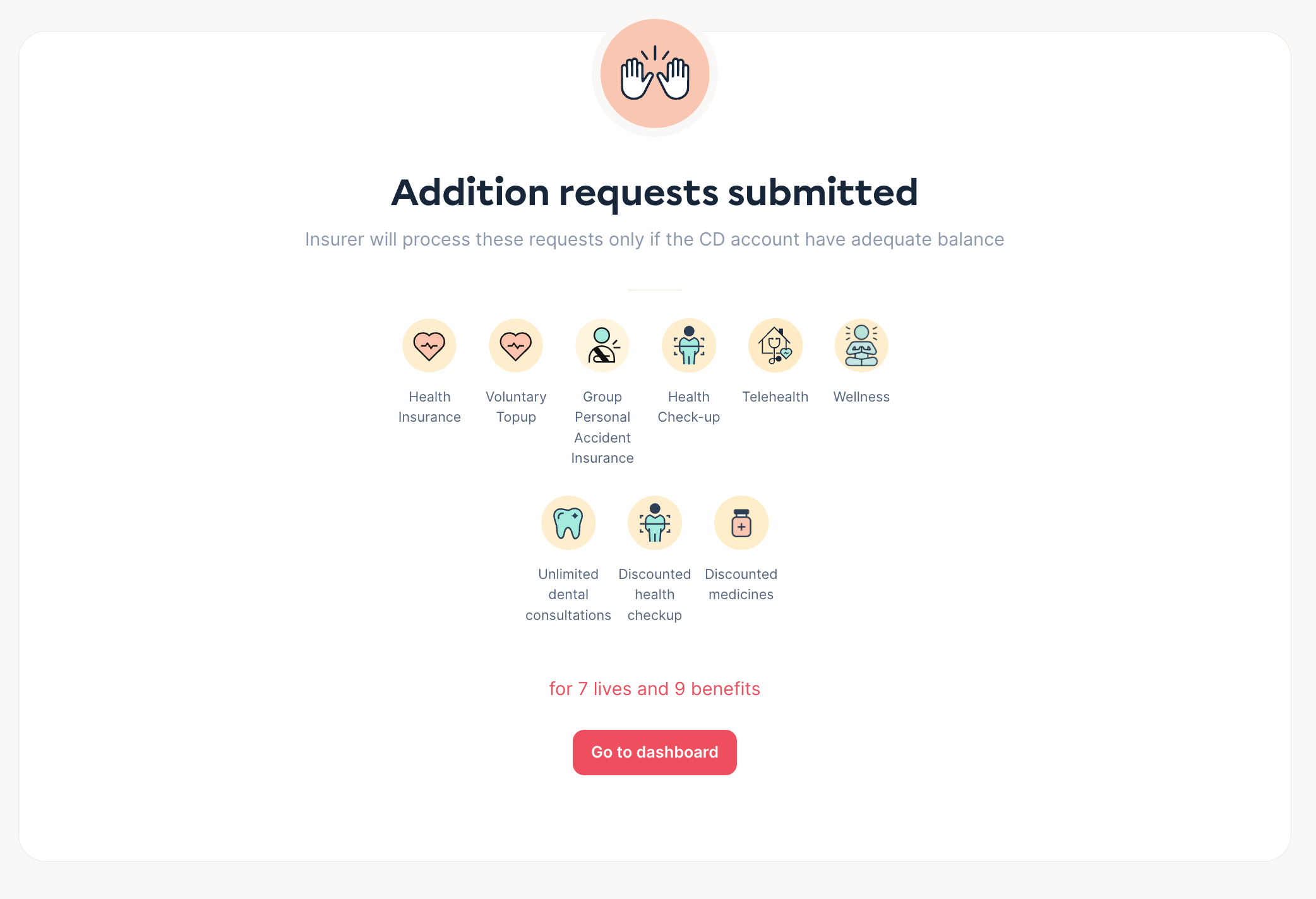

- Users are notified about the status of their requests via emails or in-app notifications.

- Once the insurer has processed the endorsement request, the final decision (approved or denied) is returned to the system.

- The system updates the policy data based on the endorsement decision.

- A final notification is sent to the user about completing their endorsement request.

In terms of engineering complexity, implementing these workflows would require developing robust front-end and back-end systems, managing complex data structures, handling asynchronous operations (e.g., waiting for the insurer's response), error handling and retries, managing user notifications, ensuring data consistency and integrity, and more.

At Plum, we are creating a Salesforce-like system for insurance processes. This system is designed to be adaptable, regardless of the size of your organization or the type of employee records system you use. It integrates seamlessly with your existing onboarding and offboarding workflows, ensuring your employees receive appropriate insurance coverage. Additionally, we provide a robust, bank-grade platform for managing your insurance accounts.

Sounds like an interesting problem? We are looking out for an Engineering Manager to lead the creation of our Salesforce-like insurance platform, where you'll tackle complex workflows in policy management, system integration, and user experience in the dynamic world of insurance technology.

Sounds like an interesting problem?

We are looking out for an Engineering Manager to lead the creation of our Salesforce-like insurance platform, where you'll tackle complex workflows in policy management, system integration, and user experience in the dynamic world of insurance technology.

Join us

Comments