Configuration management is really important in the insurance business for keeping things accurate and efficient, especially in India, where there are more than 30 different insurance companies. Each company has its own tech and systems, making the whole scene diverse. Insurance processes themselves can be intricate, involving numerous stages and conditions that can change over time or vary from insurer to insurer. Managing these multifaceted workflows and adjusting them to changing circumstances is a daunting task requiring a robust system.

To handle the complex challenges in insurance, a good configuration management system is a must-have. This system helps you make and change workflows in an organized way. It even lets you study the effects of any changes before making them official, avoiding mistakes and surprises. The benefits are many: we save money, work more efficiently, and offer better experience to customers.

In this blog post, we will explore how Plum, an insurtech platform, has crafted its unique role as an intermediary in the sector by building a robust and adaptable configuration management system.

What is Plum and the Role of Intermediary

Plum serves as a digital broker between insurance companies and businesses, using technology to make complicated insurance processes easier. We are trusted by over 3000 businesses and have insured over 5L lives.

Handling Multiple Providers and Configurable Stage Management

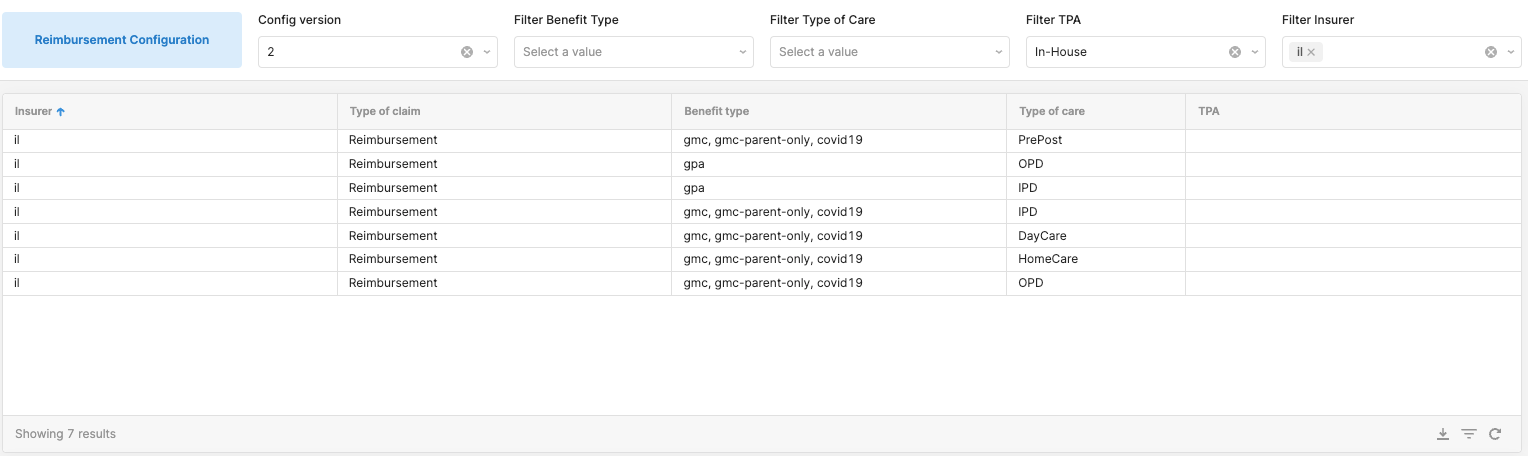

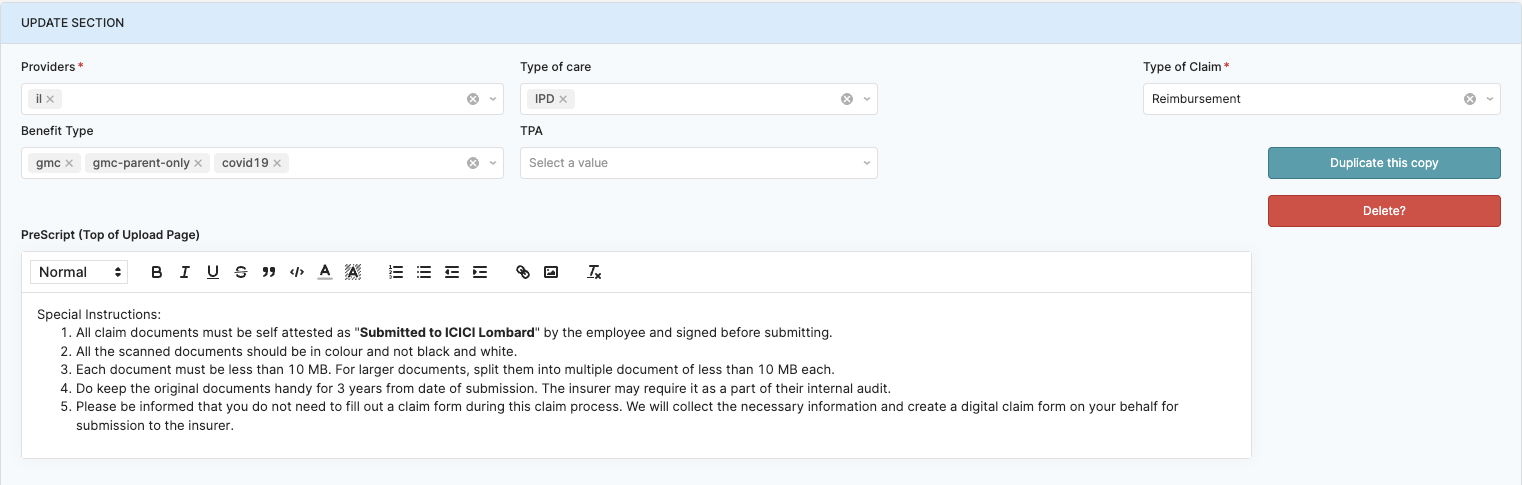

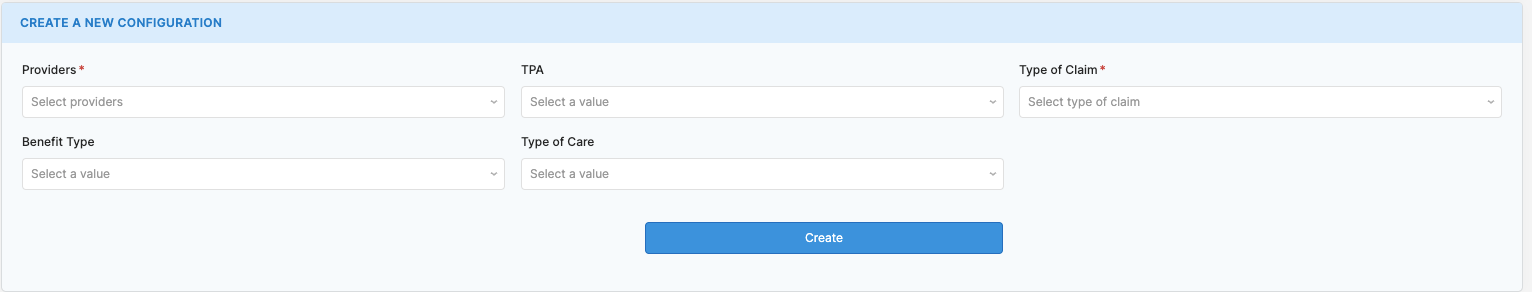

In our system, configurations are stored against each insurer, type of benefit, and type of claim. This granular level of detail allows us to provide tailored experiences for each interaction and transaction.

Different insurers may require different claim stages. Our system offers a flexible claim process pipeline. The stages are not fixed; they can be customized to suit the needs of any insurance provider or claim type.

Benefit Types

- GMC (Group Medical Coverage): Provides health coverage to employees as a group.

- GPA (Group Personal Accident): Covers accidental death and disability.

- GTL (Group Term Life): Offers term life insurance to a group of people, usually employees, under one contract.

Claims Types

- IPD (In-Patient Department): Costs incurred during hospitalization.

- OPD (Out-Patient Department): Costs for treatments that don’t require hospitalization.

- Pre/Post Hospitalization: Costs incurred before admission and after discharge from the hospital.

Claims Stages

Here's a simplified, ordered list of multiple stages based on timelines for claims:

- Inquiry

- Open lead

- Qualified lead

- Disqualified lead

- Claim ID generated

- Pre-authorization initiated

- Pre-authorization approved

- Pre-authorization rejected

- Claim registered

- Documents requested

- Documents submitted

- Documents in review

- Documents ok

- Documents update requested

- Health ID pending

- Policy pending

- Under investigation

- Approved

- Rejected

- Final settlement initiated

- Final settlement approved

- Final settlement rejected

- Settled

- Paid

- Paid closed

- Archived

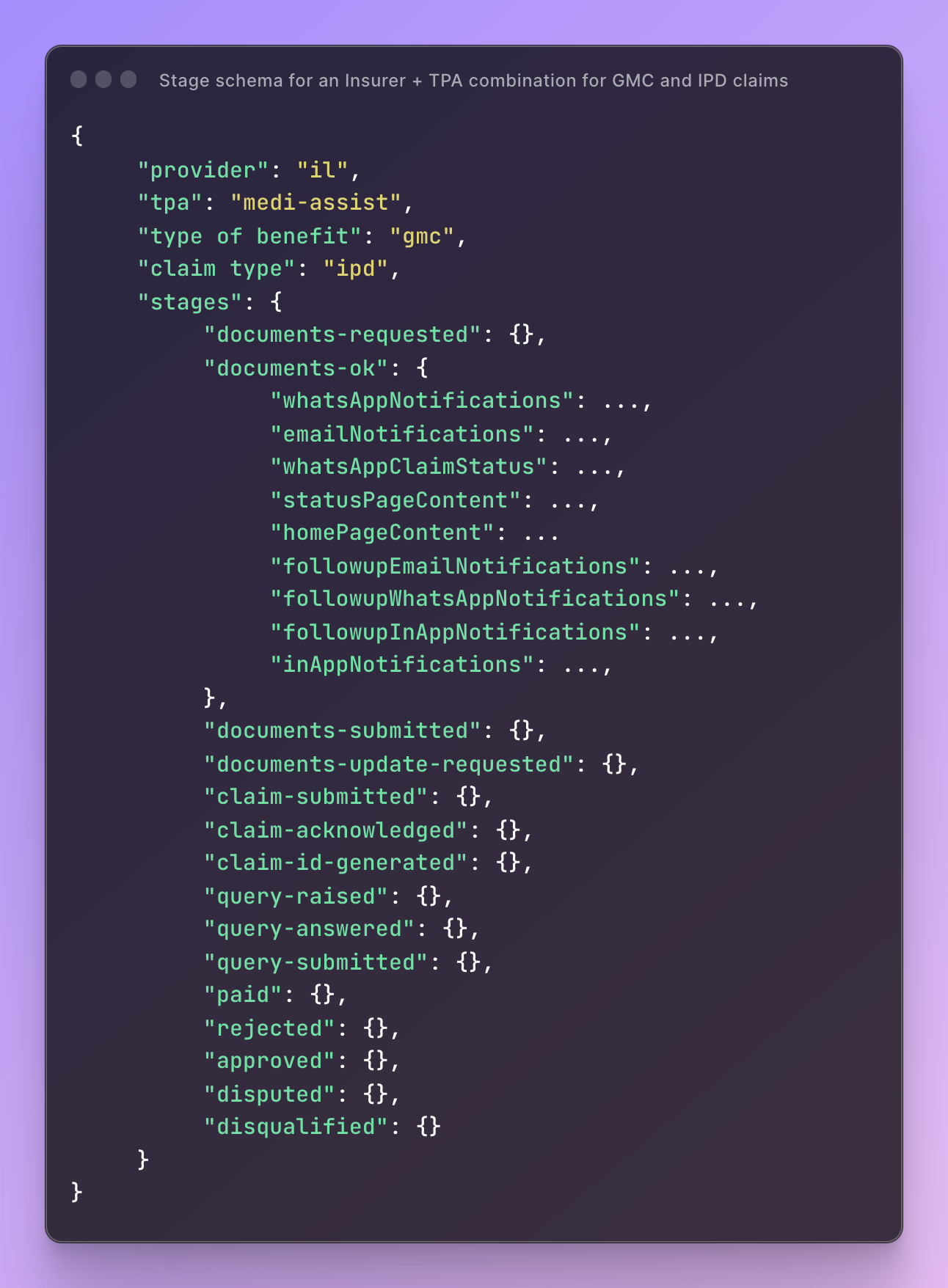

Stage schema

The Schema Image below represents the architecture of our stage handling system. This system is designed to be both robust and flexible, accommodating the unique requirements of different insurers, benefit types, and claim categories. It outlines the workflow from initial inquiry to claim settlement, providing a blueprint that can be customized but remains standardized for operational efficiency. This schema is instrumental in ensuring that each stage in the claims process is executed systematically, making it easier to manage, track, and audit.

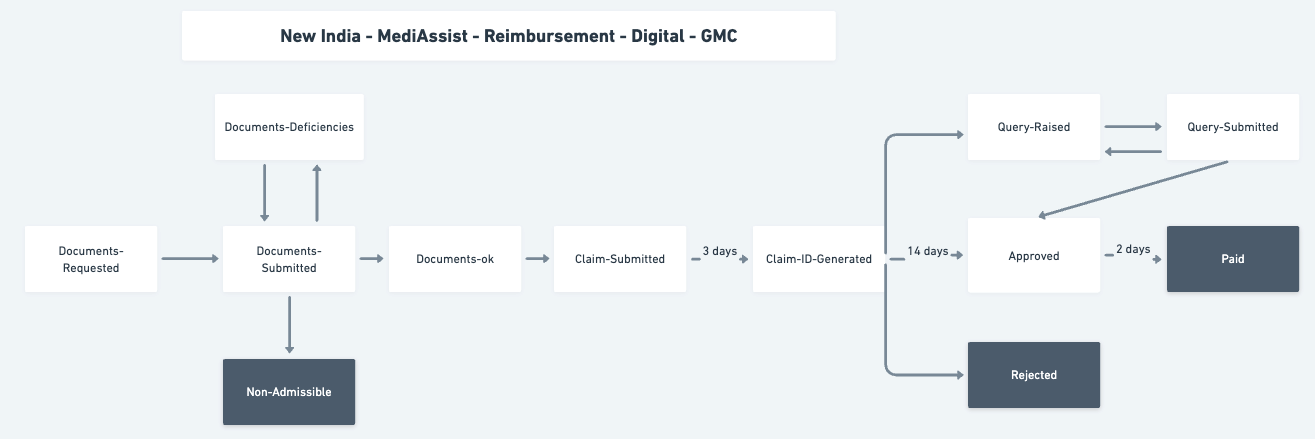

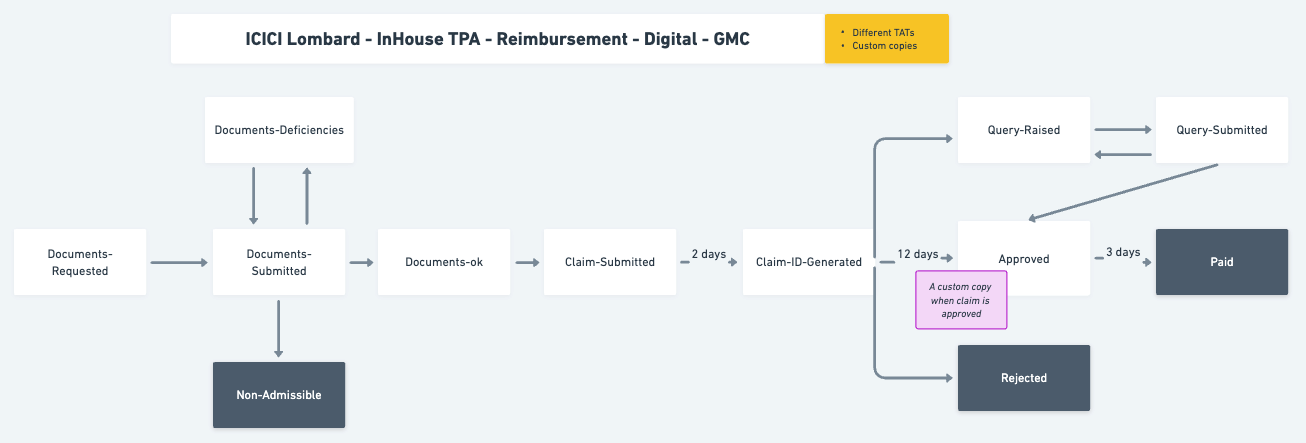

Next possible stages

Config for the next possible stages is a key feature that allows for dynamic transitions within the claims process. This configuration defines what the next permissible stages are for any given current stage. For example, once a claim reaches the "Pre-authorization approved" stage, it can only transition to either "Claim registered" or "Documents requested" based on predefined conditions. This ensures that the process flow adheres to the guidelines set by insurers and aligns with the types of benefits and claims involved. By setting these rules, we create a structured yet adaptable workflow, which can be audited for compliance and analyzed for process optimization.

Stage flows for two different configuration

Advantages of stage configurability

- Customization: Allows insurers to tailor their offerings more accurately to customer needs.

- Scalability: Facilitates seamless integration of new benefit types or claims types as the industry evolves.

- Efficiency: Reduces manual intervention and errors, streamlining the decision-making process.

Provider-specific Communication and Templating

Plum's system allows tailored communication for different insurance providers. It uses a specialized language, or DSL, to customize templates for various stages in the claims process. Stored as JSON, these templates can be for any claim stage like claim_created or claim_approved, meeting both regulatory guidelines and the unique requirements of each provider.

Here are all the communication formats that we support for each stage:

app_statuswhatsapp_claim_statusin_app_notificationswhatsapp_notificationsemail_notificationsfollowup_email_notificationsfollowup_whatsapp_notificationsfollowup_in_app_notifications

In each stage of the claims process, we offer flexible notification configurations to suit the specific needs of insurance providers. Here's a quick overview with some examples:

- Documents Requested:

followup_in_app_notificationscan remind claimants to submit necessary documents. - Documents in Review:

email_notificationscan keep claimants informed about the review process. - Claim Registered: Utilize

home_page_contentto update claim status for claimants on their dashboard dynamically. - Claim ID Generated: Employ

whatsapp_claim_statusto send a quick update to the claimant about their claim ID. - Approved: Once approved, trigger

whatsapp_notificationsto swiftly inform the client. - Settled: For the final stages,

email_notificationscan be configured to include details of the settlement.

This multi-channel notification setup ensures that both the provider and claimant are consistently informed, enhancing user experience and operational efficiency.

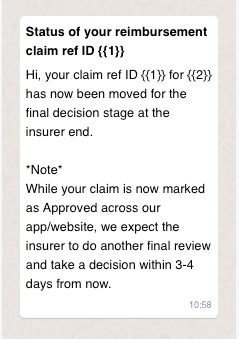

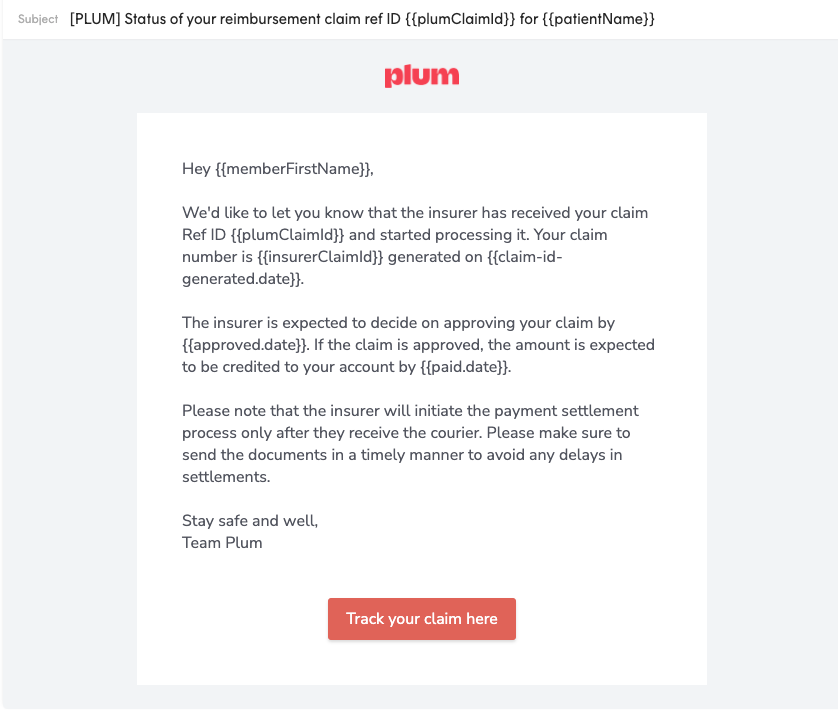

Notifications for Whatsapp and email received by user at different stages

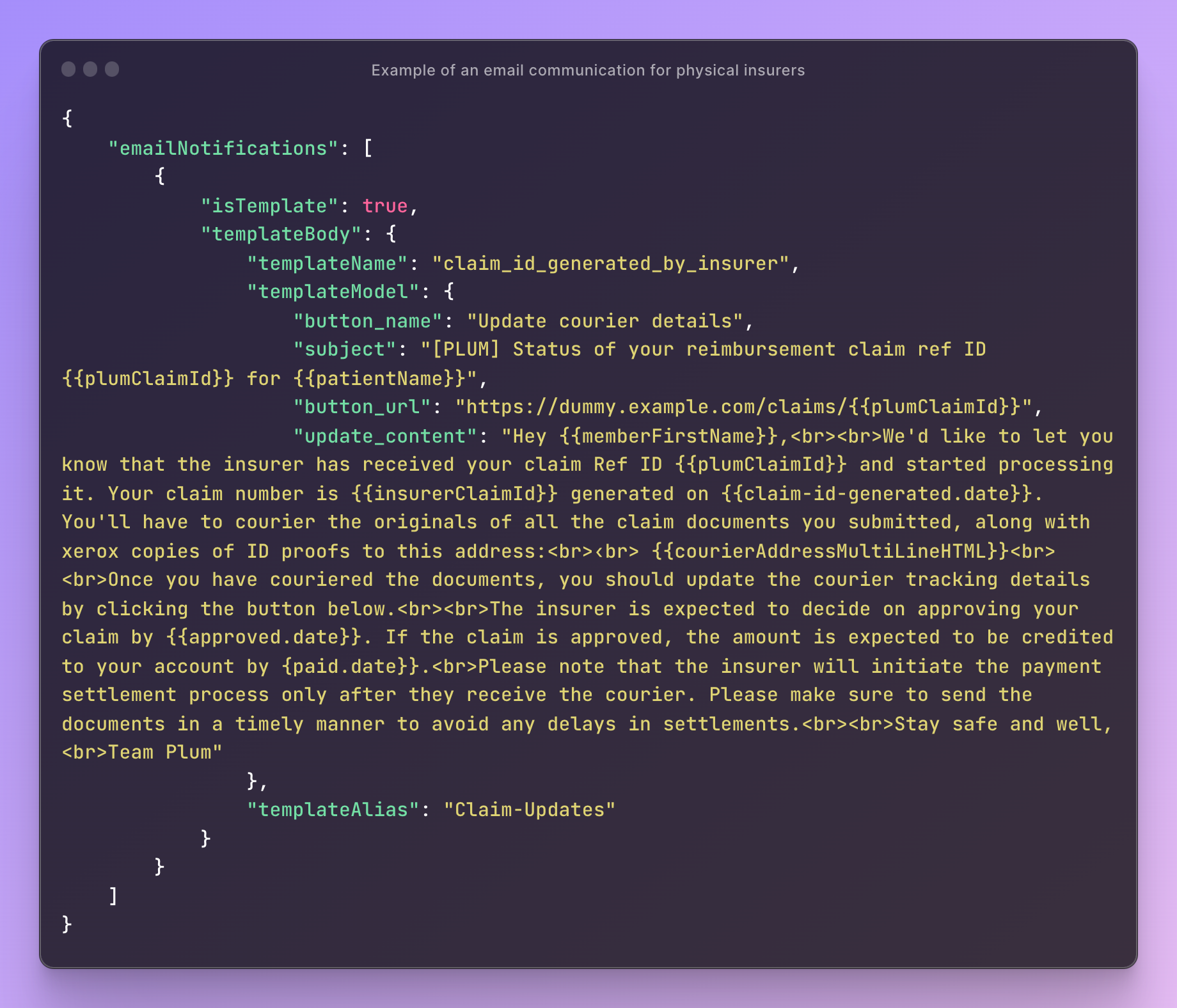

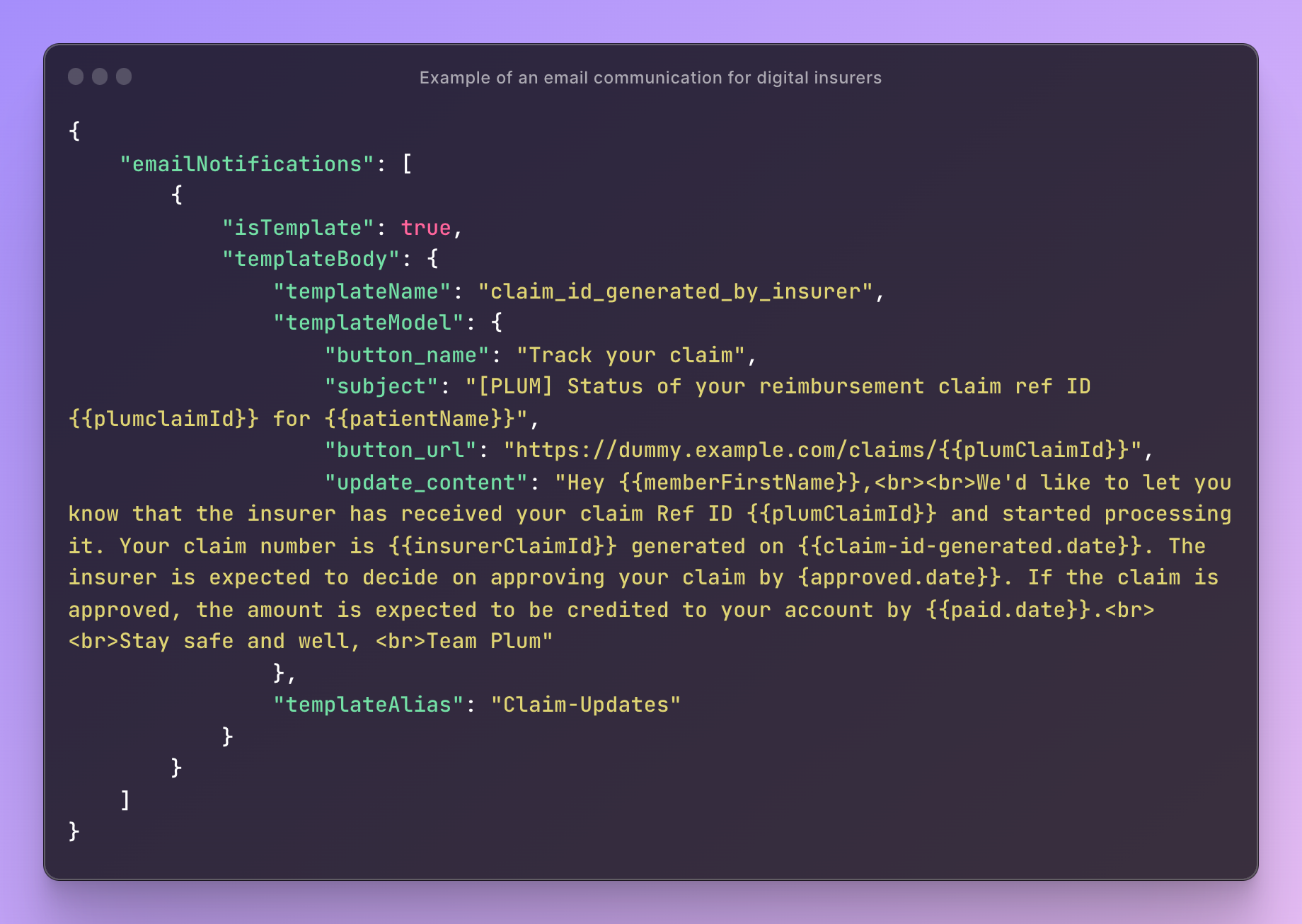

Here, we provide the JSON code snippets that power the email notifications you saw in the previous section. These configurations are built to customize notifications for different stages and for different insurance providers.

Email notification templates for different claims type configuration

Retool for Configuration Management

Managing the configurations requires a tool that is both robust and user-friendly. Retool fits the bill perfectly. Retool is a platform that enables businesses to build custom internal tools quickly. It helps reduce the development time for these tools, allowing more focus on core product development and enhancing the product's overall efficiency.

Imagine a dashboard where admins can not only view all the configuration elements but also modify them in real time. With Retool, Sugato (our PM - Claims) can add a new insurance provider, tweak the claim process of the provider, or update the communication template for the provider, all from one single interface.

Adding or updating a new provider config

This not only simplifies the process but also ensures data integrity, as changes are reflected across the system in real time. So, there's no need for Sugato to worry about data synchronisation issues or outdated information floating around.

Usually, adding a new insurance provider or altering a claim process would require significant code changes, rigorous testing, and cautious deployment. But with Retool, we have made these tasks as simple as updating a spreadsheet.

It also frees up the developers' time, allowing them to focus more on enhancing the product's core features and performance. In this way, Retool has become an indispensable part of Plum's configuration management strategy.

Summary

The system allows granular customization for different stages of insurance claims, supporting multiple communication formats such as WhatsApp, email, and in-app notifications. The configuration management tool Retool enables real-time updates, making the process more efficient and freeing up developers to focus on core product enhancements.

If you have any ideas for us to learn or improve upon, give us a shout here in the comments!

Comments